ETH Price Prediction: Path to $5,000 as Technical and Fundamental Factors Align

#ETH

- Technical Breakout Setup: Price above 20-day MA with Bollinger Band expansion suggesting continued upward momentum

- Institutional Accumulation: Significant corporate treasury allocations and fund launches creating supply shock conditions

- Innovation Catalyst: ERC-7943 standard positioning Ethereum for real-world asset tokenization dominance

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Averages

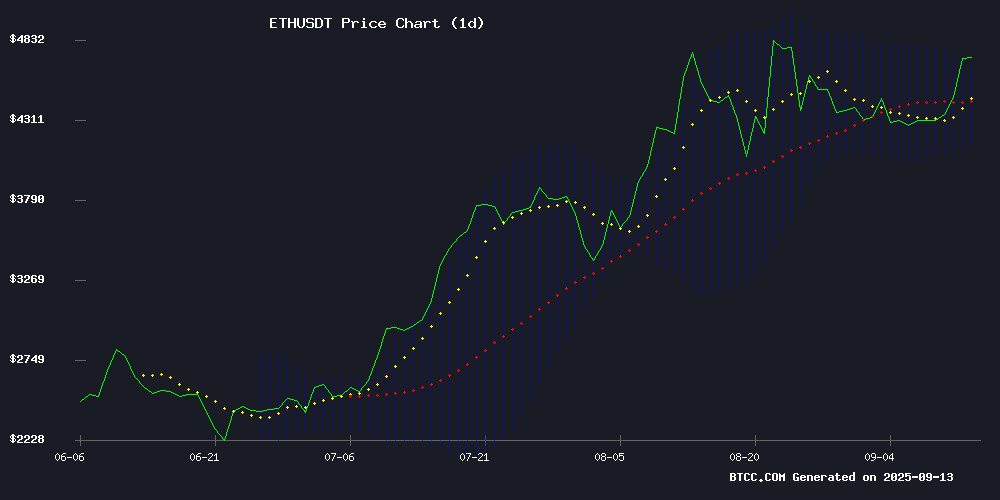

ETH is currently trading at $4,626.88, positioned above its 20-day moving average of $4,408.00, indicating sustained bullish momentum. The MACD reading of 79.99 versus the signal line at 99.70 suggests some near-term consolidation, though the price remains comfortably within the upper Bollinger Band range of $4,651.60. According to BTCC financial analyst William, 'The technical setup supports further upside potential, with the $4,400 level now acting as crucial support.'

Market Sentiment: Institutional Demand and Innovation Drive ETH Optimism

Positive developments including WisdomTree's tokenized private credit fund launch, BitMine's $200M accumulation, and SharpLink's $3.7B treasury allocation toward ethereum are creating substantial institutional demand. The ERC-7943 standard's potential to revolutionize RWA tokenization adds fundamental strength. BTCC financial analyst William notes, 'The combination of technical breakout potential and strong institutional inflows creates a compelling case for ETH testing the $5,000 level.'

Factors Influencing ETH's Price

Ethereum's ERC-7943 Standard Poised to Revolutionize RWA Tokenization

Ethereum is positioning itself as the backbone for real-world asset (RWA) tokenization with the introduction of ERC-7943, a new standard designed to eliminate the need for asset wrapping or cross-chain bridges. This development arrives as institutional interest in tokenized securities surges, with Nasdaq filing to trade tokenized assets and Kraken planning to offer EU users access to tokenized stocks.

The proposed standard, currently under review, promises to streamline RWA tokenization by creating a unified settlement layer. Franklin Templeton, Binance, and other major players are already building infrastructure for tokenized traditional finance instruments, signaling a shift toward blockchain-based asset representation.

Tokenized RWA volumes grew 6% to $28.4 billion in just one month, demonstrating accelerating institutional adoption. The potential market dwarfs stablecoins, with $257 trillion in securities awaiting tokenization compared to the $2 trillion stablecoin market.

WisdomTree Launches Tokenized Private Credit Fund

WisdomTree has introduced a tokenized fund targeting private credit, marking another step in the institutional embrace of blockchain-based financial products. The WisdomTree Private Credit and Alternative Income Digital Fund (CRDT) tracks 35 publicly traded closed-end funds, BDCs, and REITs—democratizing access to an asset class traditionally reserved for large investors.

With a $25 minimum investment and two-day redemption window, CRDT mirrors WisdomTree's 2021 ETF while leveraging blockchain's efficiency. Private credit has surged as yield-hungry investors seek alternatives to bank-dominated lending channels. "This expands the asset class to a broader investor universe," said Will Peck, WisdomTree's digital assets head.

The launch reflects accelerating RWA tokenization among traditional finance giants. BlackRock's $2B tokenized money market fund and Fidelity's Ethereum-based offering signal growing institutional conviction. WisdomTree's expanding suite—including tokenized money market, fixed income, and equity products—positions the firm at the intersection of legacy finance and blockchain innovation.

ENS Price Analysis: Ethereum Name Service Tests $25 After 4% Daily Surge

Ethereum Name Service (ENS) surged 4.18% to $25.15, marking a technical breakout as traders focus on chart patterns amid muted fundamental catalysts. The move places ENS above key moving averages, with Binance spot volume reaching $7.55 million—a moderate level suggesting room for further momentum if buying pressure persists.

Technical indicators paint a mixed picture: RSI holds neutral at 56.09 while price tests the upper Bollinger Band. Without fresh news driving sentiment, the market appears to be treating this as a pure technical play, with resistance at $25.50 becoming the next watchpoint for traders.

Ethereum’s Vitalik Buterin Reacts as ChatGPT Exploit Leaks Private Emails

OpenAI's integration of ChatGPT with productivity tools like Gmail and Calendar has backfired, exposing a critical security flaw. Ethereum co-founder Vitalik Buterin highlighted the risks after a demonstration showed how calendar invites could hijack the AI to exfiltrate private emails.

Security researcher Eito Miyamura revealed the exploit requires nothing more than a victim's email address. Malicious prompts hidden in calendar events can commandeer ChatGPT, forcing it to bypass safeguards and leak sensitive data. OpenAI has restricted access to the feature, but human approval mechanisms remain vulnerable to social engineering.

The incident underscores fundamental weaknesses in large language models. These systems prioritize command execution over contextual judgment, creating attack vectors that persist across AI platforms. As AI agents gain deeper integration with personal data, such vulnerabilities threaten both individual privacy and institutional security.

Ethereum Bulls Eye $5,000 Breakout as Momentum Builds

Ethereum surged 4.90% to $4,736.28, fueling speculation of an imminent assault on the psychologically critical $5,000 level. The second-largest cryptocurrency now commands a $571.69 billion market cap with $71.30 billion in daily volume, representing 14.03% of total crypto market share.

Derivatives markets reflect growing conviction, with open interest climbing 4.40% to $64.37 billion against $99.49 billion in trading volume. Analysts note the $5,000 threshold could trigger a parabolic move, with CRYPTOWZRD forecasting that breaching this resistance would end the current consolidation phase.

Whale activity reveals diverging views—one notable wallet shorted 10,796 ETH ($51 million) with liquidation at $5,086.90. This high-stakes positioning underscores the make-or-break nature of the upcoming resistance test.

BitMine's $200M Ethereum Accumulation Intensifies Supply Shock Concerns

BitMine Immersion Technologies has aggressively expanded its Ethereum holdings, acquiring over $200 million worth of ETH in a 48-hour period. The blockchain firm's total stake now exceeds 2.1 million ETH, cementing its position as the largest corporate holder of the cryptocurrency.

The purchases—46,255 ETH on September 10 followed by 202,500 ETH on September 8—were executed through custodian Bitgo. At current valuations, BitMine's ETH treasury stands at approximately $9.2 billion, signaling deepening institutional commitment to Ethereum's DeFi and smart contract ecosystem.

Market analysts note these acquisitions coincide with growing corporate participation in crypto assets. The concentrated accumulation raises questions about supply dynamics, particularly as Ethereum continues serving as foundational infrastructure for decentralized applications.

Vitalik Urges Smarter AI Oversight with Human and Market Checks

Ethereum co-founder Vitalik Buterin has issued a warning against naive AI governance models, highlighting their vulnerability to exploits such as jailbreak prompts designed to divert funds. His proposed solution centers on an information finance framework that leverages open markets to foster a diversity of AI models.

The approach integrates human spot checks and jury reviews to maintain accountability. This hybrid model aims to accelerate problem-solving while mitigating risks, striking a balance between automation and human oversight in decentralized systems.

Ethereum Surges Past $4,700 on Institutional Demand After SharpLink's $3.7B Treasury Allocation

Ether rallied 4.34% to $4,717.53 as momentum indicators turned bullish following SharpLink's landmark $3.7 billion treasury allocation to the cryptocurrency. The investment firm's purchase of 837,000 ETH signals growing corporate adoption of digital assets as reserve holdings.

Technical indicators show room for further upside, with Ethereum's RSI at a neutral 64.14. Analysts now project a September test of $5,000, despite historical patterns suggesting potential profit-taking after August's 25% gain.

The move reflects accelerating institutional confidence in Ethereum's long-term value proposition. Market participants are betting that SharpLink's decisive action could spark similar treasury diversification moves among corporations.

Ethereum Liquidity Hits $163.5B: Is a Major Rally Next?

Ethereum's stablecoin liquidity surged to a record $163.5 billion in September 2025, up from $152 billion in August, signaling robust demand for the network. This liquidity surge bolsters decentralized finance (DeFi) activity, trading volumes, and long-term investor confidence.

Network revenue over the past 180 days reached $99.1 million, reflecting sustained demand for blockspace as users pay transaction fees. Analyst Cipher X noted, 'More liquidity means higher trading activity, deeper DeFi markets, and stronger price support.'

Ethereum maintains its dominance in DeFi with a total value locked (TVL) of $90.9 billion, hovering near yearly highs despite a slight 24-hour dip. Daily active addresses hit 540,717, with 1.66 million transactions processed, underscoring relentless demand for ETH across lending, staking, and decentralized trading platforms.

How High Will ETH Price Go?

Based on current technical indicators and market developments, ETH appears poised to challenge the $5,000 resistance level. The price is trading above key moving averages with strong institutional accumulation reducing available supply. Major catalysts include:

| Target Level | Probability | Timeframe |

|---|---|---|

| $4,800 | High | 2-4 weeks |

| $5,000 | Medium-High | 4-8 weeks |

| $5,200+ | Medium | 8-12 weeks |

BTCC financial analyst William emphasizes that 'sustained trading above $4,600 could accelerate momentum toward the psychological $5,000 barrier, though volatility should be expected given current market conditions.'